In 2026, renewable energy investment is flowing toward three areas above all others: grid infrastructure, long-duration storage, and AI-driven energy management. For investors, corporates, and startups, the opportunity is significant. However, so are the constraints. In particular, power availability, grid bottlenecks, and regulatory complexity are determining winners and losers. In this article, we explore where renewable energy investment is flowing in 2026–from solar energy and storage to grid infrastructure and the emerging greentech investment opportunities that will define the decade.

The energy transition has a new urgency in 2026. Clean energy investment hit record levels in 2025. Specifically, the International Energy Agency estimates over $2.2 trillion flowed into clean energy technologies–two thirds of every dollar spent on energy globally. As a result, governments are building factories, laying transmission lines, and competing for clean power capacity at a speed the sector has never seen.

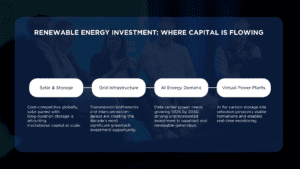

Four areas defining renewable energy investment in 2026 – from solar and storage reaching cost competitiveness to grid infrastructure emerging as the decade’s critical bottleneck.

Renewable Energy Investment: Capital Meets Execution

Industrial policy has become the primary driver of sustainable energy investment. In particular, tax credits, local content rules, and subsidies are determining where capital flows–and which markets move fastest. China leads, spending nearly as much on clean energy as the US and EU combined. Meanwhile, Europe is responding with the Net-Zero Industry Act, targeting 40% domestic manufacturing of key net-zero technologies by 2030. Similarly, India is moving fastest on integration. The Dhirubhai Energy Complex, scheduled to begin operations in 2026, will house gigafactories for solar panels, batteries, and electrolyzers under one roof.

As a result, greentech investment decisions are driven less by technology risk–which has largely been de-risked–and more by execution capacity. For example, permitting timelines, grid access, supply chain depth, and workforce availability now define competitive advantage. Therefore, investors who understand these constraints at a market level are finding opportunities that pure technology analysis misses.

AI and the Surge in Green Energy Investment

Artificial intelligence is one of the most powerful forces driving green energy investment in 2026. Specifically, data center energy demand is expected to grow by at least 130% by 2030. As a result, power access has become the defining constraint for the entire tech sector.

Utility-scale solar energy has been a direct beneficiary. It is fast to deploy, cheap to build, and increasingly paired with storage to deliver firm capacity. Additionally, nuclear, geothermal, and gas are attracting parallel investment as operators seek baseload solutions. Consequently, the result is a broader investable universe across the energy mix.

Meanwhile, virtual power plants and demand-side management are gaining traction as cost-effective complements to new generation capacity. In many markets, furthermore, the fastest source of new power comes through more efficient use of existing infrastructure. This dynamic is reshaping how sustainable energy investment funds evaluate opportunities across the value chain.

Solar Energy and Storage: The Investment Backbone

Solar energy remains the foundation of the energy transition. Specifically, deployment timelines are shorter than any other major generation source. Furthermore, costs continue to fall and the technology attracts institutional capital at scale. In 2026, therefore, solar energy investment increasingly pairs with storage to deliver the firm capacity grid operators require. Both short-duration battery systems and emerging long-duration technologies are part of this shift.

Sustainable energy investment funds are reflecting this evolution. For instance, battery storage and solar-plus-storage projects now command premium valuations in competitive markets. Additionally, Generate Capital, Breakthrough Energy Ventures, and Energy Impact Partners represent the range of capital strategies emerging across the value chain–from project finance to early-stage venture.

Clean energy ETFs are evolving in parallel. As a result, index providers are weighting storage and grid technology alongside pure-play solar and wind. For institutional investors, therefore, the composition of these indices signals where long-term renewable energy investment value is accumulating.

Grid Infrastructure: The Critical Greentech Investment Gap

Generation capacity is growing. However, grid infrastructure is not keeping pace. Specifically, transmission bottlenecks, interconnection delays, and aging networks are constraining renewable deployment across every major market. Consequently, they are also creating some of the most significant greentech investment opportunities of the decade.

Smart energy management platforms and flexible transmission technologies are attracting growing capital. Additionally, virtual power plants and distributed energy resource orchestration offer cost-effective alternatives to traditional grid expansion. This is particularly relevant, furthermore, in markets where new transmission permitting stretches into the late 2020s.

Grid investment decisions made today will determine deployment capacity for the rest of the decade. Moreover, getting them right requires cross-sector expertise that rarely sits in one room. For example, utilities, investors, developers, policymakers, and technology providers each hold a piece of the puzzle.

Why Green Infrastructure Is Centre Stage at Energy Tech Summit 2026

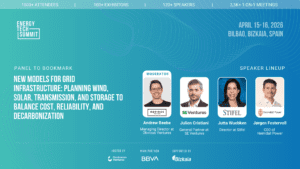

The complexity of grid infrastructure investment benefits from open, expert debate. In particular, balancing cost, reliability, and decarbonization across utility-scale and distributed models requires perspectives from across the sector. Therefore, at Energy Tech Summit 2026 (April 15-16, Bilbao, Bizkaia), two dedicated panels bring together the practitioners making these decisions firsthand.

“New models for grid infrastructure: planning wind, solar, transmission, and storage to balance cost, reliability, and decarbonization” features Julien Cristiani, Jutta Wuebken, and Jørgen Festervoll–moderated by Andrew Beebe. Specifically, the panel examines how developers and operators are rethinking infrastructure planning in constrained grid environments. Additionally, “Utility-scale vs. distributed energy: who wins on cost, speed, and decarbonization?”, featuring Vincent Gregoir, Phillip Twiddy, and Matthew Plante, tackles the strategic question every energy investor is weighing right now.

Beyond the panels, the summit brings together the full spectrum of stakeholders shaping green energy investment. For instance, institutional capital from KKR, JP Morgan, Morgan Stanley, and UBS attends alongside energy operators like Iberdrola, Octopus Energy, and Fortum. Furthermore, specialist climate funds including Breakthrough Energy Ventures, Galvanize Climate Solutions, and Systemiq Capital will be present. Ultimately, these are the investors, operators, and innovators whose decisions will determine where renewable energy investment flows over the next five years.

One of the key panels at Energy Tech Summit 2026—bringing together investors, financiers, and operators to tackle the grid infrastructure decisions that will shape renewable energy deployment for the rest of the decade.

Energy Tech Challengers: Sustainable Energy Investment Meets Innovation

Startups are addressing the hardest problems in the energy transition. As a result, Energy Tech Summit 2026’s Energy Tech Challengers competition features a dedicated Green Energy Infrastructure track. Specifically, it is designed for climate innovators developing low-carbon infrastructure that delivers reliable, resilient, and scalable energy systems.

Applicable technologies include grid stabilization innovations, flexible transmission and HVDC technologies, virtual power plants, smart energy management platforms, and EV fleet integration. In addition, the track connects founders directly with investors seeking clean energy solutions–including SET Ventures, Zouk Capital, Galvanize Climate Solutions, and Systemiq Capital.

For startups, the competition offers direct access to Europe’s most concentrated gathering of greentech investment capital. For investors, meanwhile, it provides early visibility into infrastructure solutions before they reach later funding rounds.

The Road Ahead for Renewable Energy Investment

2026 may mark a historic milestone. Specifically, energy-related global emissions could peak this year for the first time. This would happen as renewable deployment outpaces new fossil fuel demand. Furthermore, solar energy and storage are now cost-competitive without subsidies across most of the world. As a result, the economics have reached a tipping point that policy shifts alone cannot reverse.

However, the pace of deployment depends on solving harder problems. For instance, grid capacity, long-duration storage, flexible transmission, and financing structures all need to advance together. Nevertheless, these are solvable challenges. The capital is available and the technology is maturing. Moreover, the policy direction–despite regional variation–is broadly supportive of sustainable energy investment at scale.

Ultimately, for those deploying renewable energy investment capital, the frontier has moved from proving clean energy works to executing at the speed the transition demands. The investors, operators, and innovators doing that work will be in Bilbao in April. Tickets for Energy Tech Summit 2026 are now available.

Q&A: Renewable Energy Investment in 2026

Q1. Where is renewable energy investment growing fastest in 2026?

Renewable energy investment is growing fastest in grid infrastructure, long-duration storage, and solar-plus-storage projects. Additionally, markets with regulatory predictability–including the Nordics, Iberia, and parts of Asia Pacific–are attracting disproportionate capital.

Q2. How is AI driving green energy investment?

Data center energy demand is expected to grow by over 130% by 2030. As a result, green energy investment in utility-scale solar, nuclear, and grid infrastructure is accelerating across every major market.

Q3. What are sustainable energy investment funds focusing on in 2026?

Sustainable energy investment funds are prioritizing grid infrastructure, storage, and energy management platforms. Furthermore, they are moving beyond traditional solar and wind as generation capacity requires parallel investment in flexibility and transmission.

Q4. Are clean energy ETFs a reliable indicator of renewable energy investment trends?

Clean energy ETFs now include storage, grid technology, and energy management companies alongside solar and wind. Therefore, their composition offers institutional investors a useful proxy for where renewable energy investment value is accumulating.

Q5. What role do startups play in greentech investment?

Startups are addressing the hardest infrastructure problems in greentech investment–from grid stabilization to long-duration storage. Additionally, Energy Tech Summit 2026’s Energy Tech Challengers Green Energy Infrastructure track connects the most promising founders with investors shaping the sector.

Q6. What makes Energy Tech Summit 2026 relevant for renewable energy investors?

Energy Tech Summit 2026 brings together Europe’s most concentrated gathering of renewable energy investmentcapital. Moreover, the summit’s Green Energy Infrastructure theme and Energy Tech Challengers competition make it the premier platform for deal-making in the energy transition.